Changes in the PC(USA) dues structure

As common sense dictates, an insurance company needs a good percentage of healthy people in order to do well. When healthy people pay into the plan but do not need to use it often, then the company makes money.

Overall, people who are older tend to have more health problems than those who are younger. As Americans, we are living longer, but not always healthier, lives. We need more medical attention for more years. For clergy, years of eating mayonnaise salads at the potluck, lethargic sermon prep, and drinking to alleviate stress mean that our bodies are not in super shape as we reach a certain age. We’re a bit better at our boundaries, but we’re still working over 50 hours a week.

Compound the additional years with the rising costs of medical care, and we can see how much that can strain an insurance plan.

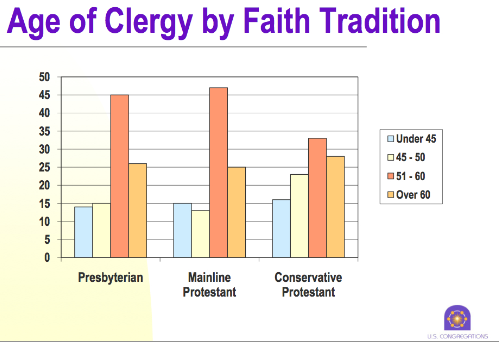

Sadly, the insurance plan of the Presbyterian Church (USA) does not have a young membership. Look closely. This is from a few years ago, but if we go by these numbers, we can see that a mere 14% of our clergy is under 45, and a whopping 70% is over 50. These are active clergy, so I’m sure the number of retired clergy that the plan is supporting is overwhelming.

The Board of Pensions (BOP) has $6.8 billion. We’ve been informed by the BOP that we’ve got a serious $28.6 million deficit problem looming and they are trying to figure out what to do about it. We need good jobs for young clergy. But I fear that what the BOP plans is going to exacerbate the problem, because it will force more young clergy out of the system.

Why do I say “more” young clergy out of the system? Because the BOP gives major incentives to clergy to stay until they are 70. Each year that clergy stay past the age of 65, allows the member to get more Social Security benefits and more BOP benefits upon retirement. So pastors stay in those prime, end-of-the-career callings longer. With the stock market crash, many pastors need to do this, but giving perks to those who work past retirement age bottlenecks the system so that younger clergy cannot get calls.

Now, not only does the BOP plan to give retirement age clergy incentives to work longer, but they also have a proposal for a new dues structure called “Dues Plus.”

•Member dues for health insurance will be 19% of effective salary (this goes down from 21% for those who do not have dependents).

•Mandatory dues would cover 65% of dependent coverage.

•Members choose what kind of coverage that they want: members plus partners, members plus children, member plus family.

Why is this Dues Plus plan bad for younger clergy?

First, many young pastors can’t handle another expense.

I don’t know if you’ve talked many young clergy lately, but they are not faring well in our system. It’s no wonder that 41% of clergy dropout in the first 10 years of professional ministry. They have educational debts that have piled up, even as our seminaries have hoarded more endowment money and poured millions into their building projects.

Even after earning a Master’s and passing all of their Ordination Exams, they often have to spend months or years doing additional unpaid internships, while some preparation committees have no consideration for how costly it is for them to go so long without work.

When housing was booming, many churches got rid of their manses and left those entering the market to figure out how to pay for jumbo mortgages on minimum salaries.

Now young clergy will have to pay for 35% of their dependents’ coverage. Our denomination already has the greatest salary inequities than any other church. We just might make it worse by making those who are starting with families pay more.

Second, this will discourage young pastors from getting jobs.

Young pastors are often turned down for positions because a retirement age minister wants the job. When a church is struggling to pay for a pastor, they can hire a pastor who is already retired, so they don’t have all the financial obligations that they would with a full-time, installed minister.

If we incentivize retirement age clergy to stay in the pastorate longer while making it cost more for those with children, we will make our young clergy crisis worse and there will be less young pastors in the system.

And so, my friends who work with the BOP ask, “What would we suggest for a solution?”

1) Don’t make your announcement from Hilton Head. I know it would only be a symbolic move. I know it’s petty. But you’re asking clergy with families to pay way more for coverage. When you ask people who work at minimum salaries, employ food stamps to feed their kids, and have gone into debt to serve the church to figure out how they’re going to cover the cost of health care for their family, the news feels a lot nastier when it’s coming from older white people at a cushy resort town.

There’s a lovely place called Stony Point. They have great food. That’s where we go for our educational events. I highly recommend it for your next meeting.

2) Keep the medical dues at 21% across the board (or raise them, if needed). Why should pastors with families pay more so that everyone else can pay a lesser percentage? Why would those with the greatest debt and the least salaries pay more so that cuts can be made across the board?

3) The big-steeple churches can pay their fair share (see maximum participation basis). Our dues are presently 21% of our effective salary, unless you get paid a whole lot of money. Then, there’s a maximum dues level. The BOP kicks in and our salary inequities are made even greater by giving them a break on their percentage. They pay less. Why not charge them the same percentage as the rest of us? After all, they can afford it.

4) Keep the optional coverage in some cases. If a pastor is making 28k and his wife is a lawyer making 500K, and she has gold-plated insurance with dental, then it makes sense that the kids and the spouse would be covered on the law firm’s plan. But that’s a totally different than asking a family at a small church in a rural area to cough up that 35% when they’re being paid the minimum salary.

5) Research the financial impact of retirees entering our process. I hesitate to write this, because I do not want to perpetuate ageism against those who are retirement age. But when I was in seminary, I watched as people who had retired from other occupations graduate, receive calls, serve for a few years, and retire. What impact do these trends have on our insurance?

Are there other ideas? Surely we can be more creative about this.

I’m not in the insurance business, but it’s pretty clear that making things more difficult on younger clergy will not ensure the health of this plan in the long run.

Are you interested in other thoughts on the Board of Pensions' move? Here are other posts on the issue (I'll add more as I'm aware of them):