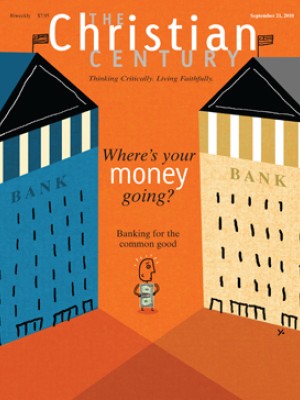

Where’s your church’s money? Banking for the common good: Banking for the common good

The classic film It's a Wonderful Life is making a comeback—not as a nostalgic feel-good story but as the centerpiece of a campaign to change the way we bank. It's George Bailey versus Mr. Potter played out at the local ATM.

The Move Your Money project began as a New Year's resolution at the Huffington Post website. The project enlisted filmmaker Eugene Jarecki to create a mashup YouTube video (which has attracted over 518,000 views) that combines clips from It's a Wonderful Life with C-Span footage and commentary to urge people to move their money from scandal-ridden megabanks to local institutions. In response to the housing crisis, predatory lending, subprime loans and rampant gambling on derivatives, individuals can change the banking industry by moving their money from the six largest banks—Citi, Bank of America, JPMorgan Chase, Wells Fargo, Goldman Sachs and Morgan Stanley—to community banks or credit unions.

This sentiment was echoed in a recent announcement from the Appleseed Fund, a socially responsible mutual fund, which declared that it would no longer invest in what it counts as the five "too big to fail" banks (unlike Move Your Money, Appleseed does not include Wells Fargo in the list because that bank's derivative holdings are less than $10 trillion). Appleseed is the first socially conscious investing firm to exclude banks from its investments—in effect adding banking practices to other issues of moral concern, such as alcohol, tobacco, pornography, working conditions, environmental impact and weapons production.

Read our latest issue or browse back issues.

Both Appleseed and Move Your Money assume that banks can be a tool for creating good and not just for creating profit. The temptation might be to write these efforts off as naive and overly idealistic. We too easily fall prey to a cynicism that assumes that all of our options are bad—that "banking for the common good" is a contradiction, that all lending is exploitative, that all business is corrupted by greed.

This is surely not true. Cynicism is a form of sloth by which we refuse the hard work necessary to make moral judgments. We live in an economy that no doubt is compromised and disordered but within which, nevertheless, better or worse choices can be made.

The new focus on banking practices forces us to consider banking as a moral issue. For many of us, choosing a bank is a matter of finding convenient branch locations, low fees and high interest rates on savings, CDs and mutual funds. In other words, the decision is a simple financial calculation: where would I get the best deal?

I suspect this is how most churches choose their banks as well. We look for the best deal and then pat ourselves on the back for our good stewardship, as if stewardship had to do simply with saving money rather than putting our money to good use.

The challenge is that banking has a high level of invisibility. We deposit money and we withdraw money, but what the money does once it disappears into the bank is, or has been, largely invisible (and uninteresting) to us. While at least some churches have sought to be socially responsible in investing their endowment, many congregations, dioceses and national bodies remain rather unreflective about where they keep their money for regular banking. The current crisis has, if nothing else, lifted the curtain on what happens to both our investments and our loans once they disappear behind the teller's counter.

So can churches become more discerning about where they keep their money? Might this be a moral issue that has slipped under our radar, just as sweatshops did for so long? And if so, what criteria would help us make better banking choices?

The history of the Christian debate about usury gives us some hints. Despite his reputation for giving a Christian blessing to capitalism, John Calvin was quite candid about his assessment of lending at interest: "Usury almost always travels with two inseparable companions: tyrannical cruelty and the art of deception." (This term is now widely taken to refer only to lending at excessive or unlawful levels of interest. But Calvin uses the term usury in the classical sense to mean any lending at interest, and I will follow this usage throughout this essay.) While Calvin does not exclude, in principle, the possibility of just exchanges involving interest-based lending, he thinks that in practice such lending almost always tends toward cruel and deceptive exploitation of the poor. He voices a discomfort and suspicion concerning usury that until recently has characterized even the most permissive Christian views.

While the Old Testament disallowed the practice of usury among Jews, it did allow such lending by a Jew to gentiles. In the New Testament Jesus seems to exclude all usury, and he even challenges lending itself in favor of a more radical disposition through almsgiving. Through the Middle Ages the church maintained a prohibition on usury, though making a profit on the lending of money was not unknown. Indeed, by the 14th century in Italy such practices were widespread, though generally conducted off the books.

In 1515, at the Fifth Lateran Council, Leo X issued a papal bull allowing for lending at interest. It was not long before John Calvin made similar allowances among Protestants. But lest we imagine this shift as a single moment that signals an avaricious fall from grace, it is helpful to note that lending at interest had already become a morally complex issue for the church. In the 14th and 15th centuries, the Franciscans founded many institutions of lending known as montes pietatis, intended to give assistance to the poor and save them from predatory lenders. The montes would charge an administrative fee for making the loan in order to sustain the institution (a practice denounced by the Dominicans, who saw it as a hidden form of usury). In retrospect, the montes pietatis look a lot like modern microfinance. The Franciscans provided sustainable loans to the poor whose only other options were exploitative.

The papal bull legitimizing the montes was fraught with ambiguity, since Leo X was a Medici, part of a family that had been profiting from banking and under-the-table usury since the 14th century. People who were greedy to profit from the changing economic world of the Renaissance were pressuring the church to alter its views. The work of the Franciscans on behalf of the poor, however, held out the possibility of brokering just loans that would serve human good while creating a mutually beneficial exchange for lender and borrower.

Where does this history leave us, the inheritors of the market-based and credit-driven economy that arose quickly in the wake of the Renaissance, the Reformation and the Enlightenment? Where do we stand in relation to banking practices constituted by boundless variations on the one theme of interest-based lending?

Few in the church have any lingering questions or qualms about usury. Perhaps we should still worry that interest as such fails to serve a good human economy. But given that there are faithful precedents for brokering just loans in service of real need and given our practically inescapable participation in an interest-based economy, the relevant question may not be "Should Christians loan at interest?" but "What would it look like today to participate in lending and borrowing in such a way that it served human good and benefited all parties involved?" Such a question might, in fact, lead us to more radical proposals for social change than would come from simply rejecting capitalism from the sidelines.

Here Calvin again proves to be a helpful guide. As we've seen, he was quite reluctant to allow usury and did so only with clear restrictions intended to conform the practice to justice and the common good. "To be certain, it would be desirable if usurers were chased from every country, even if the practice were unknown," he wrote. "But since that is impossible, we ought at least to use it for the common good."

Among Calvin's rules for rightly ordered money lending were the following.

1) One should not lend money at interest to the poor. Lending at interest made moral sense to Calvin only if it functioned as investment in someone's business rather than exploitation of someone's need. The proper response to indigence was to lend without interest or expectation of return.

2) Lending should follow the precept of "natural equity." Equity for Calvin was displayed most clearly in Jesus' command to do unto others as you would have them do unto you. Interest-based lending is just only when it is perceived by all parties as mutually beneficial. This sense of equity was not, he argued, to be based simply on common practice but on God's word.

3) Lending should serve not only the private advantage of the parties involved but also the wider public good. Faithful lending required a vision of how the transaction affects the larger economy and thus human flourishing in a given community.

Whether one thinks that Calvin's standards were too stringent or too lax, he resolutely thought about money lending as a moral and theological issue.

The real break with the prior Christian tradition comes not with Calvin or Leo X but with the rise of a purportedly autonomous sphere called the free market and a discipline called economics, which teaches us to see economy as a set of mathematical rules that exist outside the sphere of moral debate. The current financial crisis has led Christians and many others to ask questions not only about particular players and transactions but about whether the weight of our current financial system pushes people in a moral direction—that is, in the direction of solidarity, justice, mutual benefit and common good.

This brings us back to the Move Your Money campaign and the church's response to it. Just as the churches once led the way in divesting from South Africa as a protest against apartheid, might not churches lead the way in divesting from financial institutions that treat our investments as fodder for "casino capitalism"?

To put it simply, what would it look like to follow Jesus when it comes to choosing a bank? How can we know that what is done with our invested ("banked") money is consistent with our promises in baptism to renounce evil and to love our neighbors as ourselves? As churches, our goal with our money is to serve our mission, vision and purpose not just when we are spending it but also when we are saving and investing it. Otherwise, we let ourselves profit from unjust practices of which we are willfully ignorant.

The goal, of course, is not just to avoid unethical practices but to actively support those who are seeking to bank for the common good—that is, to broker equitable, just and charitable exchanges that are particularly beneficial to the least among us. This requires a shift in thinking by pastors, vestries, sessions, boards and church treasurers. Our choice of bank should be based not on getting the highest return or finding the lowest fees but on directing our money to the places where it will do the most good while it is being held on our behalf.

Ideally, we would look for a banking partner that holds to the idea that lending and borrowing are meant to serve the common good—one that seeks the mutual upbuilding of lender and borrower in service of the good of the wider community. We might, therefore, keep four goals in mind as we look for a bank:

1) Mutual benefit: If we think of money as a tool for creating mutually beneficial relations, then we might think about lending and borrowing as one form that reciprocity can take. The bank serves as a mediating institution organized to broker fair exchanges while providing a safe and convenient means to store and access money. For this service it earns a share in the brokered exchange. It follows that in evaluating a bank we would look for an institution that seeks to balance a fair rate of borrowing with a fair return on investing, neither exploiting one side for the sake of the other nor exploiting both sides for the sake of the institution's executives and shareholders. Some banks, functioning as corporations, assume that it is not only acceptable but their responsibility to make shareholder profits primary, in which case both lender and borrower become instruments in the service of distant investors. In such a scenario, all the incentives are directed against just exchange.

2) Common good: Calvin insisted that lending at interest can be acceptable for Christians only if we order these exchanges to the common good. Another way of putting this is to say that we should look for ways in which lending and borrowing can serve to upbuild the wider shared community of lender and borrower. A nonprofit institution, such as a credit union, will perhaps more easily meet this goal, since a) it does not have to produce excess profit to benefit a group of shareholders who very likely are not part of the local community, and b) it functions as a body of members who already constitute a community of interest, arising from a common workplace or a shared location.

3) Responsible lending: Part of the problem in the current mortgage crisis was the "hot potato" effect: bad loans were sold off, repackaged, sold again and betted against. As long as each party sold the loan before it defaulted, no one needed to worry about whether the loan was a responsible one. In order to counter this practice, we could look for banks that hold most or all of their loans until maturity and thus have an incentive to make loans that can and will be repaid. This also means that banks have no incentive to persuade (or trick) borrowers into taking out loans they probably cannot afford and, conversely, that banks have an incentive to help borrowers live within their means.

4) Concern for the least: The basic logic of lending in our current system reverses the logic of the gospel. Those who have less are charged more, while those who have much are charged less. If you are poor, you will be charged a much higher interest rate on your loan, if you can get one at all. Instead of getting the 3.8 percent APR home equity loan, you will have to rely on the 20-24 percent APR credit card rate or the 100 percent or more APR rate of a payday loan. Of course, financial logic says that you, being poor, are a higher risk for defaulting, and the investor should get a greater benefit from taking a higher risk. However, the gospel calls us to subvert this logic. We should be ready to offer low-interest loans to the poor precisely because they are the ones who most need a loan and who may well benefit most from it. This is the logic of microfinance and Muhammad Yunus's highly successful Grameen ("Village") bank in Bangladesh. As Christians, we should look for financial institutions that are willing to take risk on behalf of the least.

In the U.S., low-income lending generally comes through financial institutions certified by the Community Development Financial Institutions Fund, such as PeopleFund (peoplefund.org). But these are not deposit banks; they are funded through grants rather than investments. In rare cases an institution combines banking functions with a specific mission to lend for community development. One example of this is the Self-Help Credit Union (self-help.org), operating in North Carolina, Washington, D.C., and California. As a deposit institution, Self-Help provides regular banking services but with the stated goal of using the banked capital for community development. The return on investment is small (currently .5 percent on regular savings and up to 2.75 percent on CDs), but the point is not the return. The point is to participate in a system of reciprocal exchange by which people's money is used to create good even as it is being banked and saved for other purposes. Unfortunately, very few banking institutions combine deposit accounts and intentional community development.

Lacking access to a Self-Help type of institution, churches might begin by seeking out financial institutions that are nonprofit (credit unions are a good place to start), invested in the good of the local community (many of their loans go to local individuals and businesses) and committed to holding—and thus bearing the consequences of—the loans they make (a low percentage of their loans are sold off to larger banks).

Simply investing in an institution that is small and local does not guarantee that one's money will not be used to speculate on the next big bubble. But it does mean that accountable parties remain more accessible to the community, that one's money is more likely to support a project in the "real economy" than to support the trading of abstract financial instruments, and that one's money is not propping up a corporation committed to socializing risk while privatizing profit.

Like many gestures of discipleship, the end result may seem minimal. JPMorgan Chase & Co. will probably not notice that you've removed your account. But it is through small gestures of faithfulness that Christians mark out the contours of a new social vision. When enough of us make such gestures, God's reign becomes just a bit more visible.